- Address

- Headquarters & Design Studio

- Let’s Talk

- Office 801.494.0150

The onset of COVID-19 created unpredicted ripples across the country. One area in particular where all Utahns are seeing the pandemic’s continued effects is the state’s real estate market. However, new real estate trends are emerging as the nation moves onward.

Over the past few years, a series of situations, both expected and unexpected, have combined to create drastic changes in the market. Find out more about recent housing market trends and future predictions below and check out EDGE’s blog to stay up to date on the latest changes.

The problem was further exacerbated when COVID-19 transferred to America and created large-scale disruptions in supply chains and significant construction delays for new housing developments. The pandemic’s ripple effect of remote and flexible working situations created more cross-state movement than initially anticipated.

And finally, federal interest rates dropped, allowing potential buyers to increase their spending budgets on housing. All of these elements combined create a substantial gap between the amount of available housing and the growing number of residents.

Even as COVID-19 has simmered, remote work isn’t going away. This has allowed the freedom of movement for many Americans previously tied to their office location. In fact, 25% of predicted homebuyers have researched moving to an entirely new state between December 2022 and February 2023.

The top three most popular states people are investigating moving to are Florida, Arizona, and Nevada. Meanwhile, California, New York, and Illinois appear to have the highest number of prospective buyers searching to leave the state. Utah has a slightly higher inbound interest rate, though it is relatively even between inbound and outbound intent.

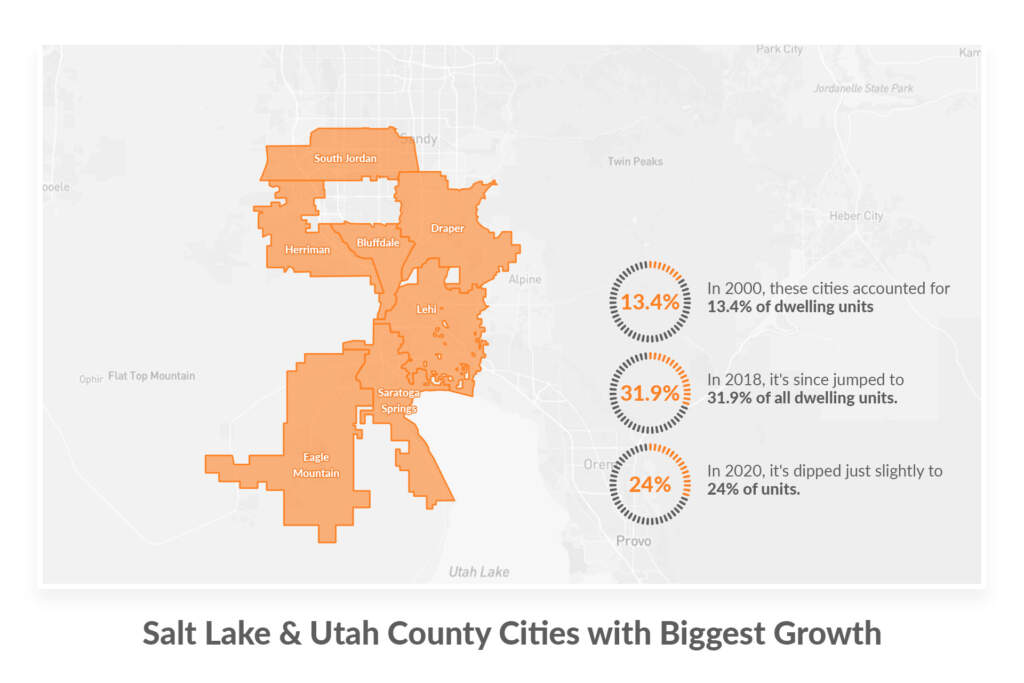

Though recent interest between inbound and outbound buyers is fairly balanced, Utah is no exception to incoming migration. The population has grown by roughly one million people over the last 20 years. Yet, that growth is not distributed evenly within the state.

The biggest growth is happening in seven cities within both Salt Lake and Utah counties:

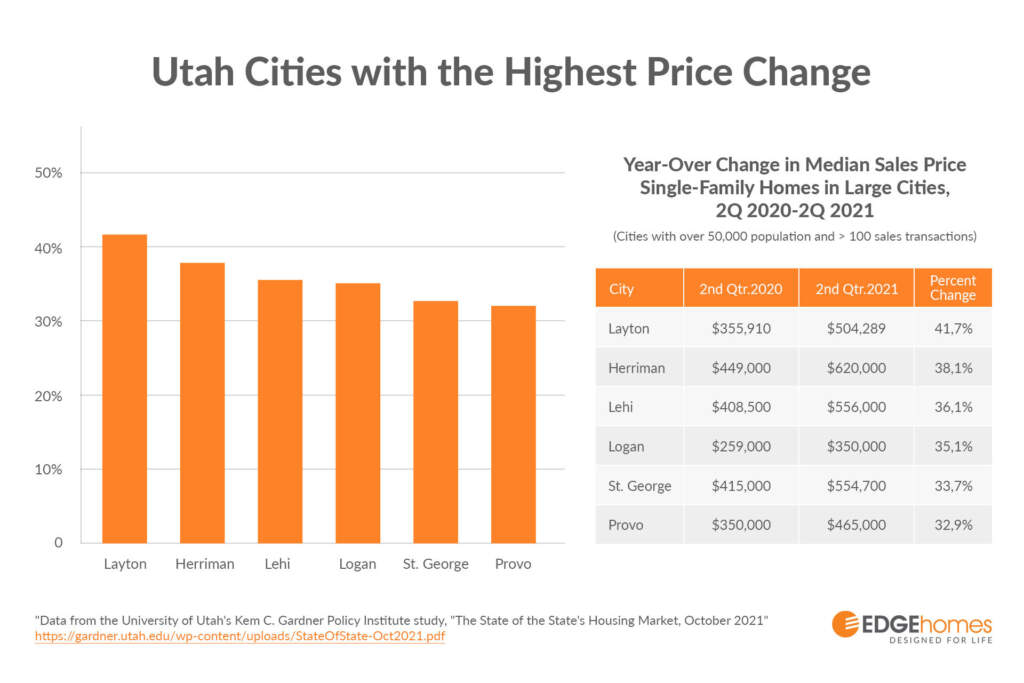

Perhaps the most talked about real estate change in the last few years has been the spike in home prices. Utah specifically has seen one of the most dramatic pricing increases year over year between 2020 and 2021 at +28%, second only to Idaho at +37%.

The median sales price increased the most in Q2 of 2020-2021 in the following cities:

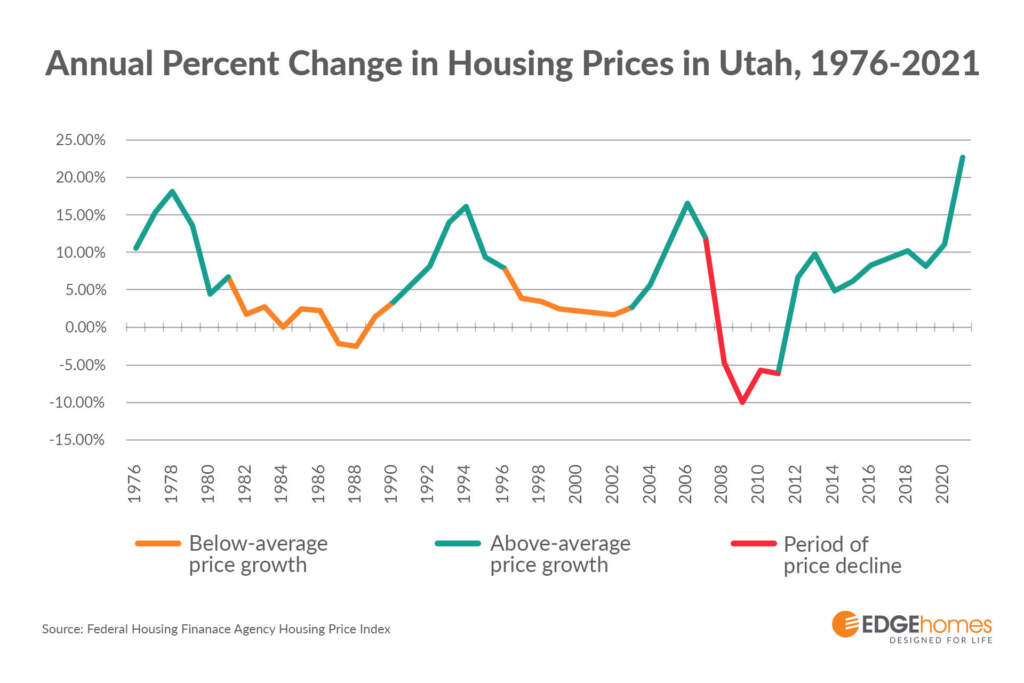

While the surge in housing prices may feel unprecedented, Utah has a very defined history of recurring pricing cycles. Since the 70s, Utah has seen a clear pattern of growth and decline that can be divided into four clear cycles. The growth periods last roughly six years, while the decline periods last an average of seven years.

Utah has now experienced a price increase over the last nine years through 2021 but has already shown signs of transitioning into a cooling period as prices began to stagnate and drop in 2022.

With this particular housing price cycle lasting longer than usual at 9 years, many Utahns are worried a housing bubble is being created. However, residents should not fear as the market has begun to shift into its natural cooling period that would prevent the drastic crash of a bubble bursting.

Already housing prices in Salt Lake County have dropped an average of $50,000 at the end of 2022. Home sales along the Wasatch Front have already dropped 22%-30% compared to 2021. Moreover, with mortgage interest rates steadily increasing and forcing buyers to lower their overall budgets, the cooling period looks as though it will pick up steam over the next few years.

To the relief of many state residents, the Utah market is already beginning to slow both in terms of skyrocketing home prices and housing demand. The average home price may finally see a decrease year-over-year and federal interest rates will not fall again for some time. However, an influx in supply should keep the general market stable.

While the overall housing shortage will likely continue for the next few years, the market is beginning to show signs of movement. In January of 2023, over 8,000 homes were actively listed for sale on the market, an increase of 82.5% from last year. Of those on the market, nearly 2,000 were brand-new listings, up almost 2% year over year. This is a significantly higher increase in homes for sale compared to surrounding states such as Idaho (+27%), California (+8%), Nevada (+33%), and Colorado (+23%).

This is good news for first-time buyers and new transplants moving to the state. More homes available on the market mean decreased competition and more options for potential buyers. EDGEhomes is committed to continuing the expansion of new housing communities within Utah.

Federal interest rates dropping below 3% was one of the major catalysts for the surge in home prices and migrations nationwide. With current mortgage rates sitting around 6-7%, the steady increase does not appear to be slowing down. By the end of 2023, experts project interest rates could increase as high as 9%.

Since its peak at nearly 17% in the early 80s, mortgage rates have been decreasing steadily for the past forty years. However, industry consensus estimates citizens will not see rates lower than 3% again in their lifetimes.

With the predicted increase in mortgage rates over the next few years, average home prices may increase. The most dramatic increase in Utah’s average home price happened between 2020 and 2021. The expected price dip may allow for more opportunities for long-term renters looking to become homeowners.

Have more questions about financing and making a competitive home offer? Check out EDGEhome’s home-buying resources here.

While real estate can be unpredictable at times, many are anticipating the 2023 housing market to cool off, allowing more buyers into the market and the impacts of the housing shortage to lessen slightly. Some are already calling for a real estate rebound in 2024 as the Utah job market and mortgage rates begin to settle. Overall, 2023 and 2024 are predicted to be years of more general stability and less dramatic change than 2020-2022.

For those interested in moving to a new home in Utah, explore EDGEhome’s latest community projects or learn more about housing trends on our blog.

SCHEDULE A VISIT