- Address

- Headquarters & Design Studio

- Let’s Talk

- Office 801.494.0150

You’re about to take a big step in your life, so it’s important to make sure you do it right. Before you even decide on a house, take the time to adequately prepare.

Feel confident in making your decisions on your first house; Home Buyer Seminars give you the chance to learn from the pros. These seminars are offered by EDGEhomes. You’ll learn how to shop for and finance a home, and since our passion is educating buyers, our seminars are free of charge.

The classic lending guideline says your principal, interest, property tax, and insurance (PITI) should amount to no more than 28 percent of your gross income—but that number is arbitrary. A few percentage points off won’t make much of a difference, but a high mortgage payment is going to hurt sooner or later.

On top of debt repayment, you have other non-negotiable bills every month: utilities, insurance, food, clothing, and other expenses. Then there are discretionary costs: savings, dining out, entertainment, travel, and fun. Not to mention it’s always smart to have savings for unexpected expenses like a brief period of unemployment, a medical emergency, or a car repair. Experts generally recommend keeping non-discretionary expenses to less than 50 percent of your take-home income. This percentage isn’t magic, but it’s a useful guideline.

You probably don’t check your credit report or credit score all that often. When working towards buying a home, being proactive and taking the time to understand your credit score can empower you to make better financial decisions. You may even learn some things you didn’t know about your credit score—and these things can be very important to buying a home. Sometimes, paying off your credit cards or an old collection account actually hurts your credit profile more than it helps. Working with a mortgage professional will help you create the best possible financial scenario while you are building your home.

When it comes to home loans, lenders always look at your debt-to-income ratio. The general rule of thumb is that your monthly mortgage payment should be between 28 and 36 percent of your monthly income, depending on your credit score.

In order to determine how much your mortgage payment should be, lenders consider the following factors:

Your household’s adjusted gross income is based on personal taxes only. If you’re self-employed, lenders look at the average of the last two years of your adjusted gross income. Typically, the higher your income, the more likely lenders will determine you’ll be able to repay the loan.

Normally, you’re expected to use your income to repay any loans. However, some lenders may view you as less risky if you have any liquid assets. Liquid assets are assets that can be converted into cash quickly, such as savings, money market accounts, stocks, and government bonds.

A credit score is a three-digit number calculated from your credit reports, based on the likelihood that you will repay borrowed money. Your credit score takes into account your delinquent accounts, unpaid collections, past bankruptcies or foreclosures, tax liens or civil judgments, recent applications for credit, and outstanding debts.

These include monthly payments, car payments, loans, and more. By combining your entire financial history, lenders can better assess what debt you can take on, and will give you a loan accordingly.

From the beginning, be upfront with your loan office. Let them know if you pay child support or alimony, or have wage garnishments. Be honest about past bankruptcies or foreclosures. Your loan officer can assess the situation, but it’s best not to let it become a curveball later. Odds are, they’ll find this information out during the loan application process anyway.

No matter what mortgage loan you qualify for, you should be comfortable with your monthly payments. Working with our loan officers, you can decide which monthly payment works for you, how much you want to save, and how much you wish to allocate toward your home. Use our mortgage calculator to get an idea of what amount will work best for you.

There are multiple types of loans* available for homebuyers:

The most common loan for homebuyers, backed by lenders rather than government agencies and set by the lender’s guidelines. A typical conventional loan requires at least a 5 percent down payment, but options can vary.

Government-backed loans available to veterans through the Department of Veteran Affairs. For those who qualify, this will be a zero-down payment loan.

Available to low- and moderate-income families, Rural Housing site loans are backed by the United States Department of Agriculture and Rural Development. However, geographic and income restrictions may apply.

Backed by the Federal Housing Administration that requires borrowers to pay mortgage insurance premiums that protect the lender if they default. This is a great option for those with lower down payment amounts.

As a home buyer you face many hurdles, but the down payment may be the most overwhelming. To help, we’ve put together a few tips to keep in mind as you begin the home buying process.

While there are different types of mortgages available, most banks require a down payment from the homebuyer in order to qualify for the loan. A down payment is typically a percentage of the amount borrowed. By putting money down on your home, you could reduce your monthly payment, the length of your loan, and have a better chance at qualifying for a larger loan amount. However, the actual effect your down payment has on your monthly payment or length of your mortgage loan may vary.

In the past, banks expected 20 percent down before even considering anyone for a new home loan. This was especially true for first time buyers without a history of on-time payments. However, putting down a large down payment is not always necessary for all homebuyers. Nowadays, there are multiple options available to first time buyers and repeat buyers alike:

These organizations offer low down payment loans, or require no down payment at all. FHA-backed loans often require as little as 3.5 percent down.

Offer down payment programs specifically for first time buyers as low as 3 percent or even 0 percent. The only drawback is that you’ll typically have a higher interest rate and higher monthly payment.

Learn more about financing to get a better idea on your options, and learn more about the EDGEhomes loan process to start on the path toward your new home.

No matter what you do, make sure you’re approved for the mortgage loan first and foremost. Don’t start your journey by falling in love with a home only to learn you can’t afford it. Set your budget, know your budget, and don’t go over your budget. By pre-qualifying first, you won’t get in over your head with excessive monthly payments.

If you go into the home buying process alone, you’ll make more hard mistakes than healthy choices. Professional advice is crucial during big decisions—and buying a home is one of the biggest decisions you’ll make. Contact an EDGEhomes agent or First Colony Mortgage loan officer todayAs a home buyer you face many hurdles, to learn more about your down payment options.

You also have more buying power than you would without a pre-qualified loan. Rather than guessing what fits inside your budget, you’ll know your limits ahead of time, allowing you to customize your home accordingly. From floor plans to decor, every decision will be that much easier after you’ve been pre-qualified.

Since first time buyers are new to the home buying process, pre-qualification details the amount of home they can afford. It’s also important because they typically don’t have as much financial history as other buyers. This means that their credit score will play a big part in the pre-qualification process. Even if they have a lower credit score than they’d like, our lenders will work with them to get it to where it needs to be.

In order to get pre-qualified for a home loan, there are a few things you’ll need:

All of these items can be given in person or attached during First Colony Mortgage’s online application process. After these items are submitted, loan officers will examine every aspect of your application to find the best loan option for you.

Building a home is a big financial decision—but one that gives you many options over buying an existing home. You can choose and customize floor plans, interior fixtures, paint colors, neighborhood locations, lot size, and more. There are also a lot of choices available when it comes to financing. Often, it’s best to work with your builder’s preferred lender.

The builder and their preferred lender are a team—and you’ll be part of that team, too. The builder and lender will work together on your behalf to not only build your beautiful home, but also to make sure financing is in order.

The preferred lender has access to important things such as contracts, builder packets, upgrades and prices of homes, deposit checks, and more. The lenders also work with home appraisers, who are familiar with the project, helping things to move faster. The lender will therefore work more efficiently through the loan because they aren’t trying to hunt down dates and paperwork.

Builders choose preferred lenders very carefully. They want to work with a lender that is an expert in new construction and knows the building process inside and out. First Colony Mortgage is a construction specialist, and the preferred lender of EDGEhomes. They help buyers pre-qualify, so when they look at floor plans and upgrades they will already know what they can afford. First Colony has in-house loan processing and underwriting to speed up the loan time and ensure the close goes smoothly.

Builders and their preferred lenders have one goal in mind: to create happy homebuyers. To incentivize homebuyers, lenders may offer home upgrades like modern flooring, granite countertops, advanced appliances, closing cost credits, and more. These incentives may vary between individual lenders, but it’s worth asking the builder—or even directly asking the lender—to see what preferred lender incentives are on the table.

Whether you are a first time or experienced home buyer, it’s important to understand that every loan has closing costs related to the home purchase. Typically, total closing costs range from two to five percent of the home purchase price, and are divided into two sections:

There are basic fees that all mortgage lenders have, including loan processing and underwriting fees, home appraisals, title settlement fees, and insurance. These costs generally don’t vary much from one lender to another.

Origination fees or origination points are paid on top of other costs. Usually these are used to buy the interest rate down, and can vary from lender to lender.

The first thing to determine is whether paying more closing costs upfront will outweigh the monthly savings of a slightly lower interest rate.

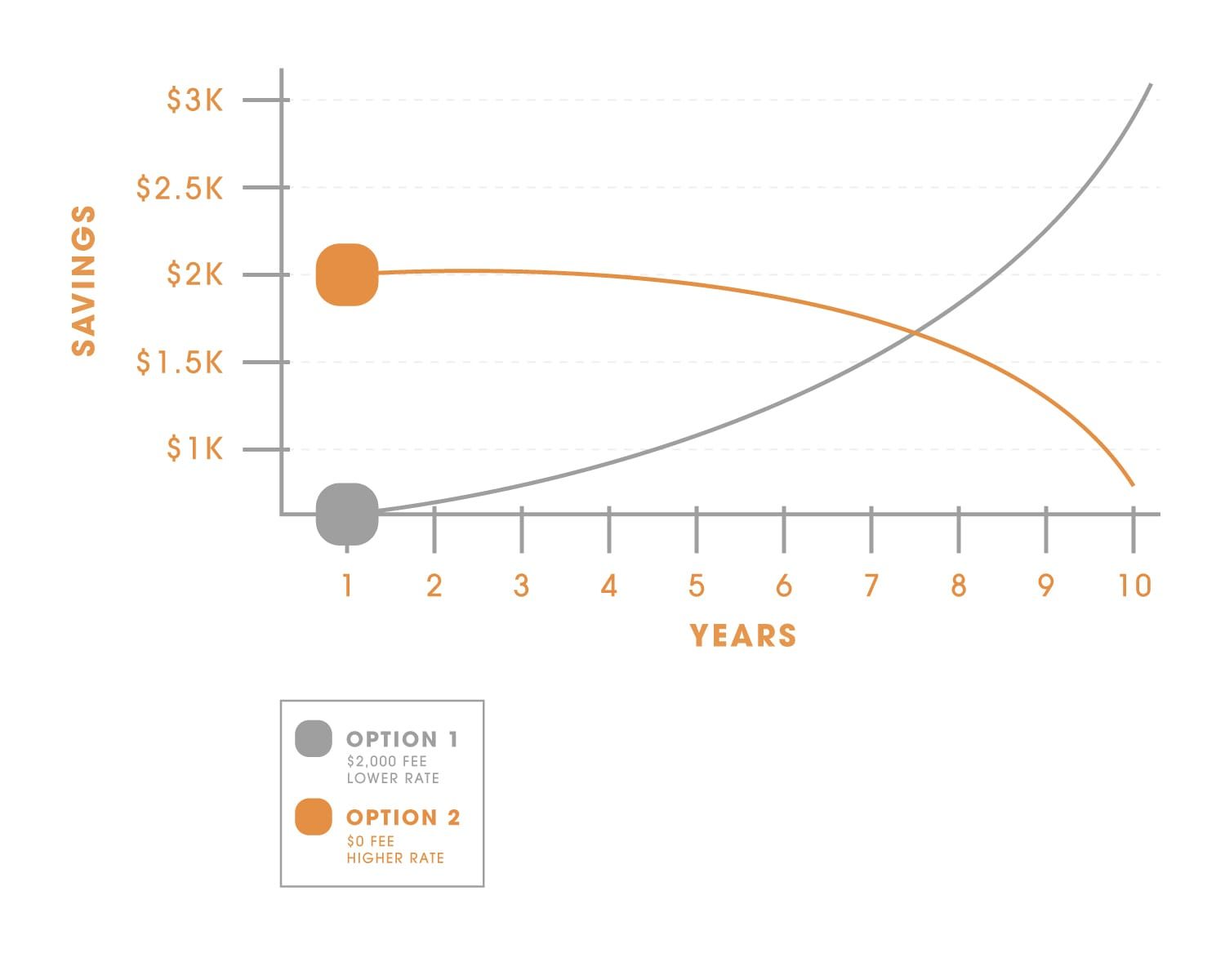

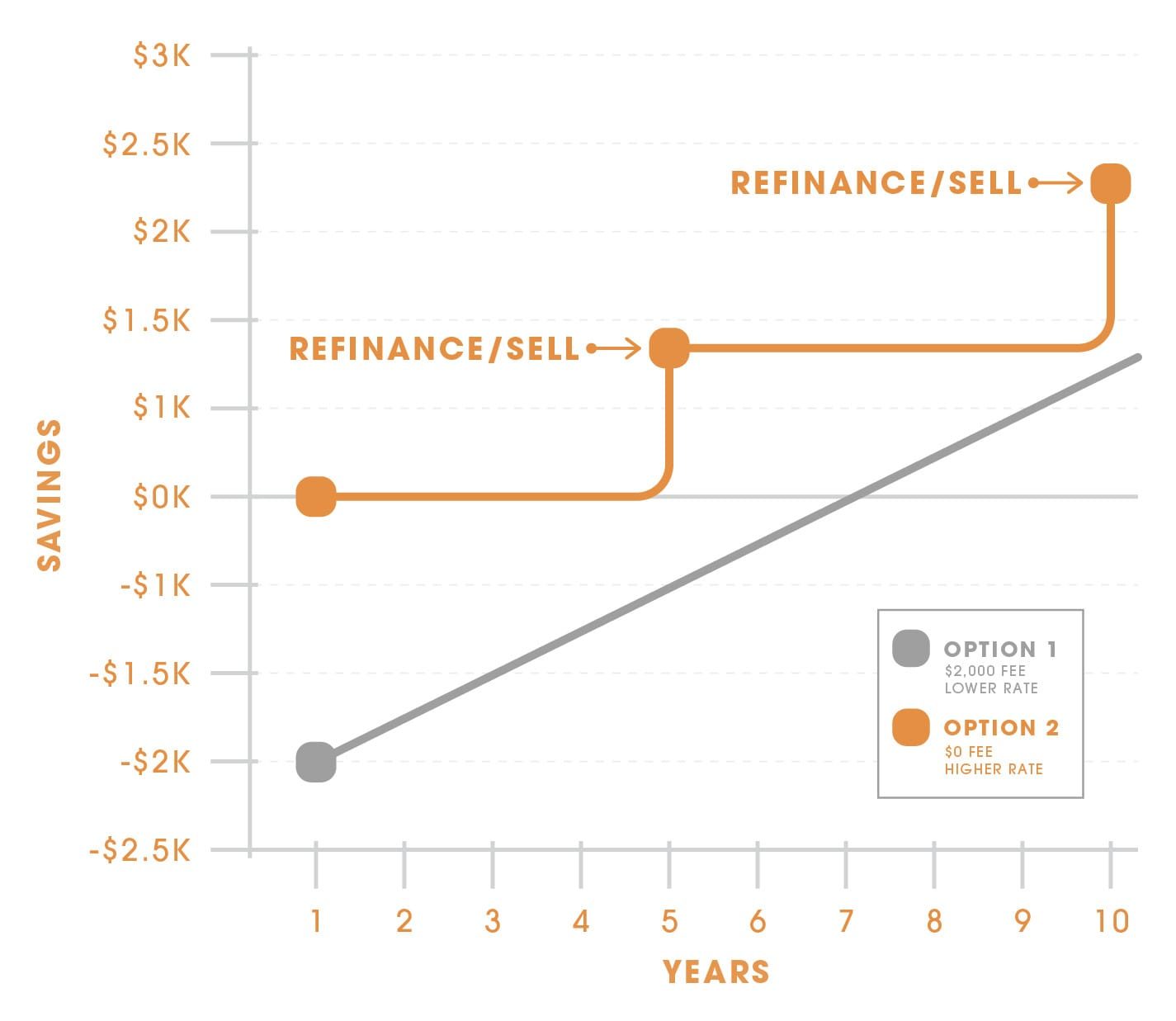

Should you pay $2,000 at closing time for an additional origination point to lower your rate, saving $20 per month on your payment? Or is it better to take a higher upfront rate, saving $2,000 in additional closing costs? In most cases, it’s better to take the higher rate with cheaper closing costs, as homebuyers rarely keep their loan for more than five years. Many will move to different homes or refinance their mortgages as rates change.

If you don’t plan on refinancing your mortgage or selling your home within the next five years, it often makes financial sense to pay for mortgage points, also known as discount points. One point will cost 1% of your mortgage. Paying this can be worth it over the years, as you will likely recoup the money you spent on mortgage points, and then some.

If you picture yourself moving or refinancing your home within the next five years, it makes financial sense to take a higher interest rate. In most cases, homeowners don’t break even or see a return on the cost of mortgage points until more than five years after they buy their home.

When you apply for a home loan with a lender, they are required to give you a loan estimate within three days. The loan estimate will show the terms of your loan, the monthly payment, and closing cost estimates, helping you plan ahead. But remember, the loan estimate is just that, an estimate, and these figures are not the final numbers.

A few days before your home-closing, you will receive a closing disclosure that gives final numbers of your loan payment and closing costs. You should compare this document to your original loan estimate to make sure they closely match. If you have any questions, talk with your loan officer. You don’t want any surprises when you sign on the loan.

It’s critical to sit down with a loan officer to discuss any questions you may have about a mortgage, costs, and your individual situation. Together, you can determine terms of a loan and any costs that come along with it.

* All loans are subject to credit approval, and various loan types have their own guidelines. See a mortgage professional for more details.

You’ve just taken your first step toward buying your new house! Contact EDGEhomes today to get started.

SCHEDULE A VISIT